One of the more notable updates in the crypto space as of late is LayerZero’s $120m raise at a $3B valuation, tripling its valuation within a year since the previous round despite the down market.

The problem that LayerZero is trying to solve is the high friction present in transferring liquidity cross-chain, allowing for apps built on top of LayerZero to transact more seamlessly.

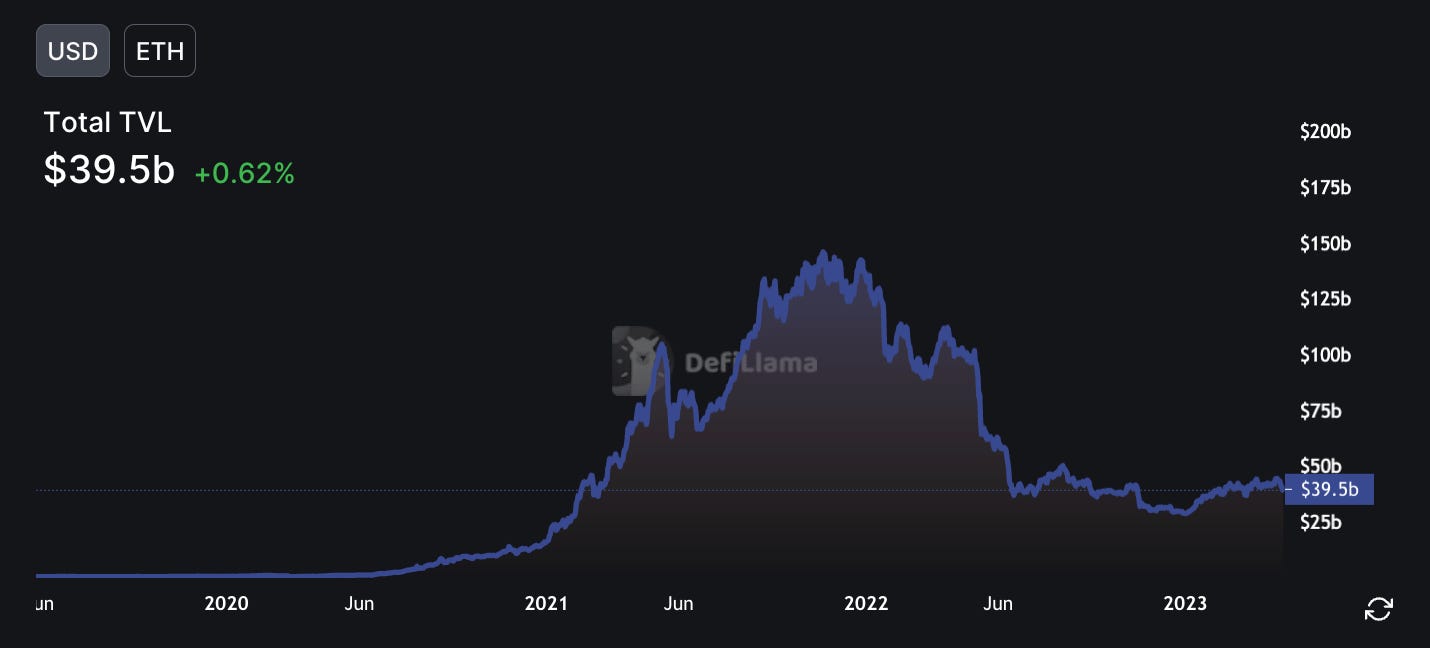

Going one step deeper, what LayerZero addresses is part of the pre-existing problem of liquidity fragmentation.

Background

Although the cross-chain liquidity issue gained more attention in the late 2010s, especially during the DeFi summer of 2020, its roots can be traced back earlier to the emergence of alternative blockchain platforms and cryptocurrencies.

In the early days of cryptocurrencies, Bitcoin was the dominant platform, and interoperability between blockchains was not a pressing concern.

However, with the launch of Ethereum in 2015 and the subsequent growth of the platform's ecosystem, the need for cross-chain interoperability and liquidity became more evident.

Ethereum introduced smart contracts, which enabled the development of decentralized applications (dApps) and fueled the creation of various tokens on its platform.

As the number of tokens and use cases grew, so did the importance of enabling seamless transactions and value exchange between different blockchain networks.

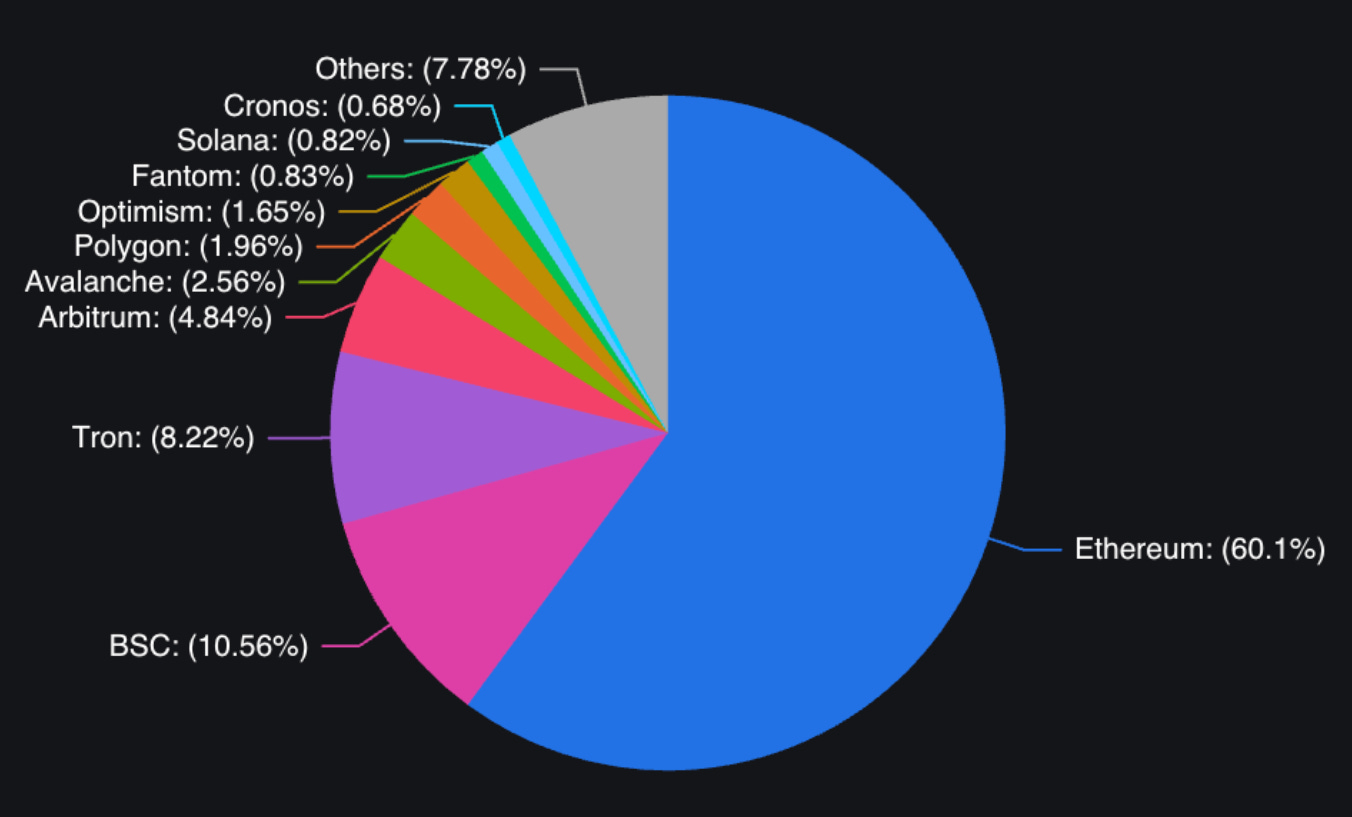

For those knowledgeable in crypto, Ethereum commands the lion's share of liquidity, and such liquidity is trapped in the Ethereum smart contracts.

One might be wondering why projects don’t just build on Ethereum to save the hassle.

Technical Consideration

Newer generations of blockchains (such as previously covered Sui and Linera) offer additional features that may be better catered to a developer’s need, such as faster to finality, stronger security guarantee, different accounting aggregation methods, different composability mechanisms, etc.

When I spoke to founders, one of their biggest concerns in building in any of the chains was whether liquidity could be bridged over (mostly from Ethereum).

This is the motivating reason why some of the founders may choose to build in multi-chain protocols such as Cosmos and Polkadot.

Access and Ecosystem Support

With any of the chains, the core team may be based in different areas of the world, and as such, the first blockchains that prospective builders come across are different depending on geography.

On the flip side, nascent chains provide stronger incentives through grants and other support that may appeal better to founders as that is the method by which chains increase network effect and build a moat.

Alternatively, because Ethereum has grown so much, it is even difficult to find a generalized ecosystem map (you can still find sectors such as DeFi).

Trading consideration

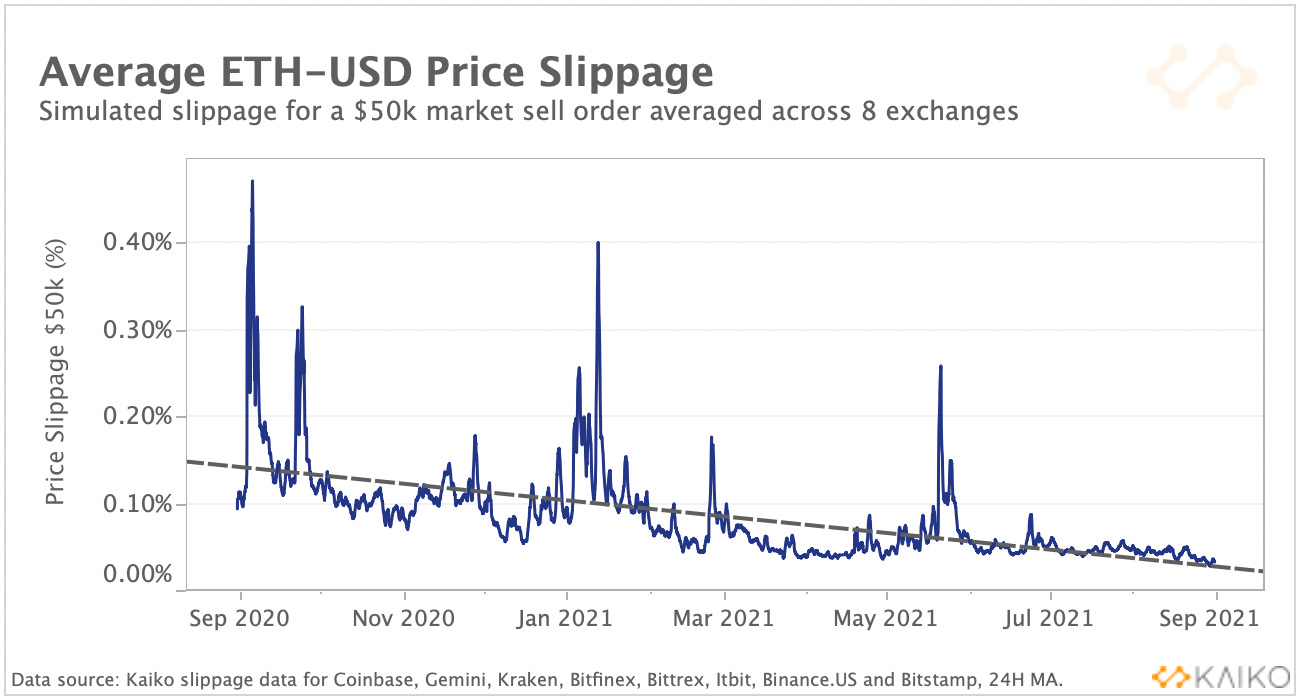

As a corollary to the above points, lower liquidity in an ecosystem generally leads to higher slippage and price volatility as the market is unable to absorb larger demands and is thus riskier to participate in.

This can lead to a vicious cycle where some may be less inclined to hold tokens in a specific chain.

Areas of Development

Atomic swaps enable trust-less, peer-to-peer exchange of cryptocurrencies between two parties across different blockchains without the need for intermediaries. They use Hashed Time-Locked Contracts (HTLCs) to ensure that both parties fulfill their part of the trade, reducing counterparty risk.

Example here.

Decentralized exchanges allow users to trade cryptocurrencies directly with each other without the need for a centralized intermediary. Some DEXs have implemented cross-chain trading capabilities, allowing users to trade assets between different blockchain networks.

Example here.

Liquidity aggregators are platforms that connect multiple decentralized exchanges, liquidity pools, and other DeFi protocols to provide users with the best prices and liquidity available. They help to optimize cross-chain liquidity by pooling resources and ensuring that users can efficiently access different markets and networks.

See 1inch.

Cross-chain bridges facilitate the movement of assets between different blockchain networks. They can be built using various methods, such as federated bridges, smart contract-based bridges, and cryptographic solutions like zk-rollups or optimistic rollups. These bridges enable users to lock up assets on one blockchain network and receive equivalent assets on another network, thus increasing cross-chain liquidity.

See wormhole.

Interoperability Protocols

Projects like Cosmos, Polkadot, and Avalanche aim to create interoperable networks that enable seamless communication and value exchange between different blockchain platforms. These protocols leverage unique architectures, such as the Cosmos Inter-Blockchain Communication (IBC) protocol and Polkadot's relay chains, to facilitate cross-chain liquidity.

See Cosmos IBC.

Wrapped tokens are tokenized representations of cryptocurrencies from one blockchain network on another network. For example, Wrapped Bitcoin (WBTC) is an ERC-20 token on the Ethereum network pegged to the value of Bitcoin. Wrapped tokens help increase cross-chain liquidity by allowing users to access assets from other blockchains within a specific network, such as Ethereum.

WBTC and WETH are good examples.

Oracle networks, such as Chainlink, can facilitate cross-chain communication by providing reliable, decentralized data feeds from one blockchain network to another. This can help improve cross-chain liquidity by enabling smart contracts to react to external events and trigger cross-chain transactions.

Chainlink is a notable example.

Final Thoughts

While most of the cross-chain solutions are aimed at bridging cross-chain liquidity, further consideration is needed as DAOs as an entity mature and the question of how to carry out cross-chain governance will be more pressing.

Additionally, while LayerZero reduced user friction by abstracting away various integrations, it still relies on bridge technology which suffered ~$2B loss in 2022 from hacks. (Source here)

Thus, more robust technologies need to be developed to ensure security down the stack.